Company Update / Automotive / IJ / Click here for full PDF version

Author(s): Giovanni Dustin ;Ryan Dimitry

- Wholesale 4W volume declined by -26% yoy in Mar24, but grew +6% mom on seasonality; in-line with our estimates, but below Gaikindo's.

- We observed higher discounts mom across all segments (+13% mom).

- Chinese 4W manufacturers to introduce more 4W BEV models in the coming months; reaffirm Hold on .

Higher wholesale 4W sales volume mom in Mar24, likely on seasonality

Wholesale 4W sales volume in Mar24 came in at 74.7k units, declined by -26% yoy, but improved by +6% mom, likely supported by seasonal demand factors, ahead of the Eid al-Fitr holidays. This was broadly in-line with our forecasts (23% of our FY24F vs. 3yr average of 25% in FY17-19 pre-COVID), but below Gaikindo's run-rate of 20%. Note that we expect FY24F 4W sales to decline by -4% yoy, amidst higher macro uncertainties (see our previousnote). 's sales volume reached 40.0k units in Mar24 (-24% yoy/-3% mom), forming 22% of our FY24F - also broadly in-line. 's 4W market share normalized to 54% in Mar24 (vs. 52/58% in Mar23/Feb24).

Discounts increased mom across all segments

Our channel checks with dealers indicated that discounts increased on mom basis in Apr24 (from Rp19.2mn in Mar24 to Rp21.9mn in Apr24; +13% mom), as discounts across all segments rose by +5-30% mom. We note that the LCGC and LSUV segments saw the highest jump in discounts at +30/27% mom, which we believe is partly attributable to competition.

GAC Aion to introduce two BEV models at GIIAS 2024

Chinese 4W manufacturer, GAC Aion, is entering the Indonesian market and will partner with Indomobil Group (; not rated) for distributions. It was established in FY17 and is a subsidiary of GAC Group, a Chinese automotive conglomerate. Notably, GAC Aion sold 480k units in FY23 globally. It plans to launch two BEV models at GIIAS 2024 in Jun24 (vs. in Aug typically), namely Y Plus and Hyper HT, which are MPV and cross-over SUV models. Furthermore, based on our channel checks, more BEV models will be launched in the coming months, including BYD Denza D9 in May24 (luxury MPV, which is likely to be a direct competitor for Toyota Alphard), Vinfast VF6/7 in Jul24 (SUV), and Neta U and S in Sep24 (SUV/Sedan).

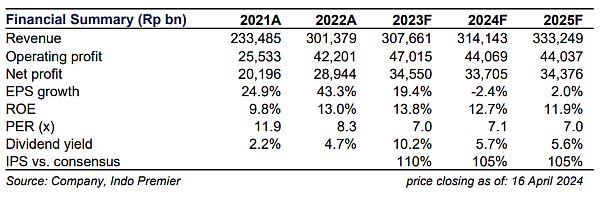

Reaffirm Hold rating, with an unchanged TP of Rp5,800

Although most of the concerns have likely been priced-in at current valuation of 7x FY25F P/E, we see limited positive near-term catalysts for . Reiterate Hold, with TP of Rp5,800/share. Risks: 1) higher/lower-than-expected 4W/2W volumes; and 2) higher/lower-than-expected commodity prices.

Sumber : IPS

powered by: IPOTNEWS.COM